In 2026, US China Technology Competition Dimon the global semiconductor industry sits at the center of a geopolitical chessboard. Chips no longer power just smartphones and laptops. They now drive artificial intelligence, military systems, electric vehicles, and national security strategies.

The United States calls its latest export controls a defensive move. China calls them containment. Allies feel caught in the middle.

Welcome to Chip Wars 2.0, where export controls shape innovation paths, supply chains, and geopolitical trust often in unintended ways.

This article evaluates how U.S. export controls affect allies and Chinese innovation trajectories, and explores alternative trade policies that balance national security with industrial resilience.

Why Semiconductors Became a National Security Issue

Semiconductors underpin modern power. Advanced chips enable AI models, precision weapons, satellite systems, and cyber defense tools.

The U.S. government tightened export controls starting in 2022, expanding them through 2024–25. These rules restrict China’s access to advanced logic chips, AI accelerators, and semiconductor manufacturing equipment.

Policymakers aim to slow China’s military modernization and protect sensitive technologies. That goal remains clear. The side effects remain less discussed.

As one industry executive joked privately, “We used to worry about transistor size. Now we worry about passport stamps.”

What US China Technology Competition Dimon Actually Do

U.S. export controls focus on three main areas:

- Advanced AI chips (especially those above defined performance thresholds)

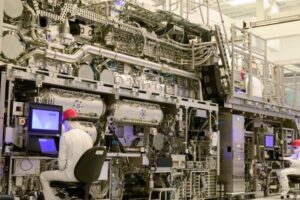

- Semiconductor manufacturing equipment, including extreme ultraviolet (EUV) tools

- Technical collaboration, covering design software and manufacturing know-how

The Bureau of Industry and Security (BIS) administers these rules under the U.S. Department of Commerce.

Trusted sources include:

- U.S. Department of Commerce (BIS)

- Congressional Research Service (CRS)

- Semiconductor Industry Association (SIA)

The intention sounds simple. The execution, however, ripples through global supply chains.

Unintended Impact 1: Allies Absorb the Shock

Japan, the Netherlands, and South Korea Feel the Pressure

U.S. allies play essential roles in the semiconductor ecosystem.

- The Netherlands hosts ASML, the world’s only supplier of EUV lithography machines.

- Japan dominates key materials and precision manufacturing tools.

- South Korea and Taiwan lead advanced chip fabrication.

When the U.S. tightens controls, allies must align or risk losing access to U.S. technology themselves.

This alignment often comes at a cost.

ASML, for example, faces restricted sales to China even when machines contain minimal U.S. intellectual property. Japanese equipment makers report lost revenue and long-term customer uncertainty.

Allies comply, but not without concern. Many policymakers quietly worry about sovereignty over trade decisions.

Unintended Impact 2: Supply Chain Fragmentation Accelerates

Efficiency Takes a Back Seat to Geography

For decades, semiconductor supply chains optimized for efficiency. US China Technology Competition Dimon now prioritize political alignment instead.

Companies redesign supply chains based on “friend-shoring” rather than cost or speed. That shift increases redundancy but also raises prices.

According to the Semiconductor Industry Association, excessive fragmentation could slow innovation and raise global chip costs across automotive, healthcare, and consumer electronics sectors.

In short, chips become safer but not cheaper.

Unintended Impact 3: Chinese Innovation Does Not Stop It Reroutes

Constraints Change Direction, Not Ambition

US China Technology Competition Dimon slow China’s access to leading-edge chips. They do not eliminate China’s innovation capacity.

Instead, Chinese firms pivot.

Evidence from Chinese industry filings and academic research shows increased investment in:

- Chip design optimization

- Mature-node manufacturing

- Domestic alternatives to U.S. software tools

- AI efficiency improvements rather than raw computing power

China’s innovation trajectory now emphasizes resilience over performance. That path may produce fewer breakthrough chips today, but it strengthens long-term self-sufficiency.

History offers a warning: restrictions often accelerate local innovation rather than suppress it.

Unintended Impact 4: Global Research Collaboration Suffers

Semiconductor progress thrives on collaboration. Export controls chill academic and industrial partnerships, even in civilian research.

Universities report increased compliance costs and hesitation around joint projects. Multinational companies limit internal knowledge sharing to avoid regulatory exposure.

Innovation slows not because engineers lack ideas, but because lawyers attend more meetings than scientists.

That outcome rarely appears in policy summaries, but industry insiders feel it daily.

Security Gains vs. Strategic Trade-Offs

Export controls deliver real security benefits. They buy time. They protect sensitive technologies(US China Technology Competition Dimon). They signal resolve.

Yet they also create trade offs:

- Allies bear economic costs

- Supply chains lose efficiency

- China accelerates indigenous alternatives

- Global trust erodes incrementally

Security does not fail but it becomes more expensive and complex.

The question for 2026 becomes practical, not ideological: Can the US China Technology Competition Dimon without weakening the ecosystem it leads?

Alternative Trade Policy 1: Precision Controls Over Broad Bans

Targeted restrictions outperform sweeping controls.

Instead of broad performance thresholds, policymakers could focus on:

- Explicit military end-uses

- Verified defense-linked entities

- Clearly defined applications

This approach mirrors long-standing arms-control logic and reduces collateral damage to civilian markets.

The Congressional Research Service has repeatedly emphasized that overly broad controls dilute enforcement effectiveness.

Precision improves credibility and compliance.

Alternative Trade Policy 2: Multilateral Rule-Making, Not Ultimatums

Allies cooperate more willingly when they help write the rules.

Formal multilateral frameworks rather than bilateral pressure would:

- Share enforcement burdens

- Reduce economic resentment

- Improve transparency

Institutions like the OECD and Wassenaar Arrangement already exist. Policymakers can modernize them for AI era technologies.

Shared rules build shared trust. Forced alignment builds quiet resistance.

Alternative Trade Policy 3: Invest More, Restrict Less

Export controls work best alongside aggressive domestic investment.

The CHIPS and Science Act represents a strong start. Continued funding for:

- Advanced manufacturing

- Workforce development

- Research commercialization

helps maintain U.S. leadership without relying solely on denial strategies.

Innovation leadership deters rivals more sustainably than permanent restriction.

As one analyst quipped, “You don’t win a marathon by tying someone else’s shoelaces.”

Alternative Trade Policy 4: Clear Off-Ramps for Compliance

Ambiguity fuels fear.

Clear licensing pathways, transparent review timelines, and published compliance standards help companies operate responsibly without paralysis.

The Semiconductor Industry Association consistently calls for regulatory clarity as a competitiveness issue not a convenience.

Predictable rules encourage investment. Uncertainty discourages it.

What This Means for Global Security in 2026

Chip Wars 2.0 will not end soon. Technology competition now defines geopolitics.

Export controls remain a legitimate security tool. Yet tools work best when used precisely.

If policymakers balance security with industrial resilience, the U.S. can:

- Protect critical technologies

- Preserve alliance trust

- Maintain innovation leadership

- Avoid permanent ecosystem fragmentation

The wrong balance risks long-term strategic erosion disguised as short-term control.

Video Of US China Technology Competition Dimon

Conclusion: Security Without Self-Inflicted Damage

Export controls aim to protect national interests. In practice, they reshape global innovation in unpredictable ways.

Allies feel pressure. Supply chains splinter. China adapts. Collaboration narrows.

None of this means controls should disappear. It means they should evolve.

In 2026, the smartest strategy blends precision, cooperation, and investment not fear-driven isolation.

Because in the race for technological leadership, the strongest advantage is not who you block but who still wants to build with you.

Trusted Sources & References

- U.S. Department of Commerce – Bureau of Industry and Security (BIS)

- Congressional Research Service (CRS) Reports on Semiconductor Export Controls

- Semiconductor Industry Association (SIA) Policy Briefs

- OECD Technology and Trade Policy Analysis

- Academic research published via IEEE and peer-reviewed semiconductor journals