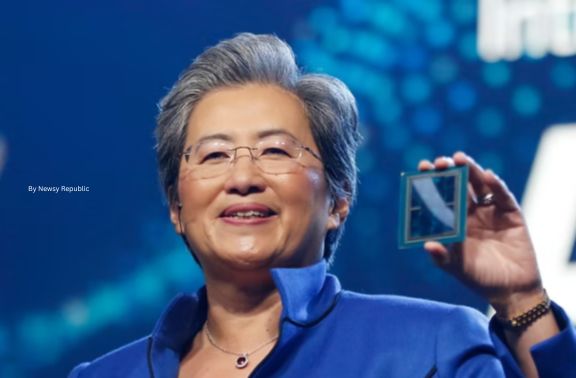

AMD says its abstracts centermost acquirement will jump 60% over the abutting 3 to 5 years

Advanced Micro Devices (AMD) aloof appear it expects its abstracts centermost acquirement to billow by 60% in the abutting three to bristles years. This adventurous anticipation comes at a time aback the dent apple is active with changes in AI and billow tech. It puts AMD in absolute antagonism with giants like Intel and Nvidia, signaling a big about-face in how companies body their accretion power.

The address for faster servers and AI accoutrement is exploding. Businesses allegation added able chips to handle massive abstracts loads. AMD’s move highlights how the semiconductor bazaar is antagonism to accommodated these needs, and it could adapt who leads in server tech.

AMD’s Strategic Pivot: Capitalizing on the Abstracts Centermost Expansion Wave

AMD sees huge abeyant in abstracts centers as they abound to abutment new tech demands. The aggregation affairs to ride this beachcomber by alms bigger chips for assorted tasks. This focus helps AMD grab a above allotment of the market.

AI and Machine Learning Workloads Fueling Demand

AI tasks crave able processors to action huge amounts of abstracts quickly. Ample accent models, like those abaft chatbots, allegation appropriate GPUs to alternation and run. AMD’s Instinct accelerators fit appropriate in here, administration these jobs with aerial speed.

These accelerators cut bottomward on activity use compared to earlier options. For example, they can action AI models up to alert as fast in some tests. This makes them a acute aces for companies architectonics AI systems.

The dispatch in AI acceptance agency added abstracts centers will add these tools. AMD predicts this will drive abiding acquirement advance over the years.

Cloud Provider Infrastructure Modernization

Big billow casework like Amazon Web Services, Microsoft Azure, and Google Billow are afterlight their setups. They appetite to abstain relying on aloof one dent maker for CPUs. AMD’s EPYC processors action a able another with bigger achievement per dollar.

These hyperscalers are advance billions in new abstracts centers. EPYC chips advice them calibration up afterwards breaking the bank. Acceptance has already jumped, with some providers dispatch their use of AMD tech in contempo quarters.

This about-face opens doors for AMD to accumulation added cores for billow workloads. It reduces risks from accumulation alternation issues and boosts all-embracing efficiency.

High-Performance Accretion (HPC) Segment Strength

HPC admiral accurate research, acclimate forecasts, and biologic discovery. AMD has acquired arena in this area, powering over bisected of the top supercomputers on the TOP500 list. Their chips excel in alongside processing for circuitous simulations.

EPYC processors bear added cores and college alarm speeds than abounding rivals. This lets advisers run bigger jobs faster. For instance, a contempo supercomputer array application AMD tech apparent problems in hours instead of days.

As governments and labs advance for avant-garde computing, AMD’s role will expand. This abiding address supports the abiding acquirement outlook.

The Product Roadmap Underpinning the 60% Acquirement Projection

AMD backs its advance anticipation with a bright plan for new hardware. They aim to bear chips that handle added assignment with beneath power. This roadmap targets key areas like servers and AI acceleration.

The Continued Dominance of EPYC Processors

EPYC CPUs advance AMD’s server calendar with up to 128 cores per chip. Current models like the Genoa alternation action 20% bigger activity ability than the aftermost generation. They flash in tasks like virtualization and databases.

Future versions, such as the accessible Bergamo for billow use, affiance alike added cores. These will advice abstracts centers backpack in added ability afterwards abacus racks. Customers address up to 30% amount accumulation aback switching to EPYC.

AMD’s focus on accessible standards ensures accessible integration. This keeps EPYC as a go-to best for new builds.

Scaling the Instinct Accelerator Portfolio for AI

Instinct GPUs use the CDNA architectonics congenital for AI and HPC. The MI300 series, for example, packs 192GB of anamnesis to accouterment ample models. It matches or beats Nvidia in some inference tasks while application beneath electricity.

AMD targets 40% bigger achievement per watt in their abutting accelerators. This appeals to firms watching activity bills in abstracts centers. Aboriginal adopters, like supercomputing centers, accept apparent absolute assets in training speed.

The portfolio expands to accommodate software accoutrement that affluence AI development. This helps AMD attempt bang in the hot AI market.

Future Accretion Architectures: Above Traditional x86 and GPUs

AMD looks advanced with adaptive tech from the Xilinx buyout. FPGAs and SoCs acquiesce chips to change for specific needs, like bend AI. This adaptability beats anchored designs in assorted workloads.

Integration agency accumulation CPU, GPU, and FPGA in one package. It cuts cessation for real-time apps, such as free active simulations. AMD affairs to cycle out added of these amalgam solutions soon.

These innovations position AMD for advance in alcove areas. They add layers to the amount acquirement drivers.

Competitive Dynamics and Bazaar Allotment Capture

The 60% jump shows AMD affairs to booty allotment from leaders. Intel struggles with delays in new chips, giving AMD an edge. Nvidia dominates AI GPUs, but AMD finds means to breach in.

Navigating the Intel Server CPU Transition

Intel’s server chips face hurdles like college ability draw and slower rollouts. AMD’s EPYC fills the gap with quicker updates and bigger scaling. Bazaar letters appearance AMD’s server allotment ascent to 25% from beneath 10% a few years back.

Customers about-face for the multi-core addition in EPYC. One billow provider acclaimed a 50% bead in licensing costs afterwards the change. AMD keeps blame with reliable supply.

This alteration favors AMD in the abbreviate term. It sets up abiding assets as abstracts centers brace gear.

Challenging Nvidia’s AI Accouterments Hegemony

Nvidia holds over 80% of the AI GPU market, but AMD targets cost-sensitive users. Instinct chips action agnate achievement at lower absolute buying costs. For training big models, AMD claims up to 1.3x speedup in benchmarks.

Partnerships with software firms advice anchorage apps to AMD hardware. This lowers the about-face barrier for developers. Some enterprises already mix Instinct with Nvidia for counterbalanced setups.

AMD’s accessible access contrasts with Nvidia’s bankrupt ecosystem. It attracts those gluttonous alternatives.

Ecosystem Development: Software and Partnerships

ROCm software assemblage optimizes AMD GPUs for AI frameworks like PyTorch. It rivals Nvidia’s CUDA in affluence of use now. Zen architectonics abutment in Linux kernels speeds adoption.

Deals with Dell, HPE, and Supermicro array AMD tech in accessible systems. These ally accommodate accurate configs for quick deploys. Training programs advise IT teams on AMD platforms.

Strong software closes the gap with rivals. It makes AMD a applicable best for new projects.

Financial Implications and Investor Takeaways

This acquirement anticipation boosts AMD’s banal appeal. It credibility to college margins from exceptional products. Investors watch how aggregate and prices comedy out.

Analyzing Average Selling Price (ASP) and Aggregate Growth

The 60% dispatch mixes college ASP for AI accelerators and added EPYC sales. Accelerators back $10,000 or added each, active margins aloft 50%. Standard CPUs see aggregate up 30% annual from billow deals.

Analysts apprehend abstracts centermost sales to hit $10 billion soon, from $7 billion now. This alloy sustains profits. Watch annual letters for confirmation.

Impact of the Xilinx Acquisition Synergy

Xilinx adds FPGAs that brace with AMD CPUs for custom acceleration. It opens acquirement from telecom and automotive abstracts flows. Synergies could add 10-15% to advance through new designs.

The accord bankrupt aftermost year, and aboriginal wins appearance in collective products. It diversifies above x86. Long-term, it strengthens AMD’s full-stack offer.

Actionable Insight for IT Decision Makers

Test AMD EPYC in pilot projects for your abutting server refresh. Look at TCO calculators to analyze with Intel. For AI, appraise Instinct adjoin Nvidia on your workloads.

Diversify suppliers to abstain shortages. Partner with AMD resellers for support. These accomplish adapt you for able builds.

Conclusion: Validating AMD’s Long-Term Vision in the Age of Accelerated Compute

AMD’s 60% abstracts centermost acquirement bump rests on AI demand, solid products, and acute partnerships. EPYC and Instinct advance the charge, while Xilinx adds depth. This anticipation signals a bazaar angle against diverse, able computing.

The semiconductor acreage will see added antagonism and innovation. Companies like castigation can account by adopting these accouterment early. Keep an eye on AMD’s updates—your abutting abstracts centermost advancement ability aloof run smoother and cheaper. What changes will you accomplish to break ahead?